Ramping It Up & The Insurance To Match

Part of deciding what types of business insurance and coverage limits a startup will need during this period are: reviewing industry trends, determining the market size, unit economics, and understanding the founders themselves. As the startup continues to grow there will be more and more shareholders with questions about what your insurance covers and if their risk is being properly mitigated.

This is a chicken or the egg problem.

At this point, you need to jump into an insurance policy tailored to your business. Do not be fooled, it is critical that an insurance expert that specializes in technology business help you through this. In the tech world, business requirements can vary tremendously, and the coverages needed do too. Winooski Insurance has many technology-focused companies in our portfolio and each of them has a different combination of insurance carriers, insurance coverage, and pricing.

Quite simply, the risk for a tech company monitoring data for tsunami detection has a different risk profile than someone developing an application to locate the nearest dog park. If your agent does not understand your technology and the technology insurance space you almost always have an issue putting together an insurance package that is appropriate for your startup’s needs.

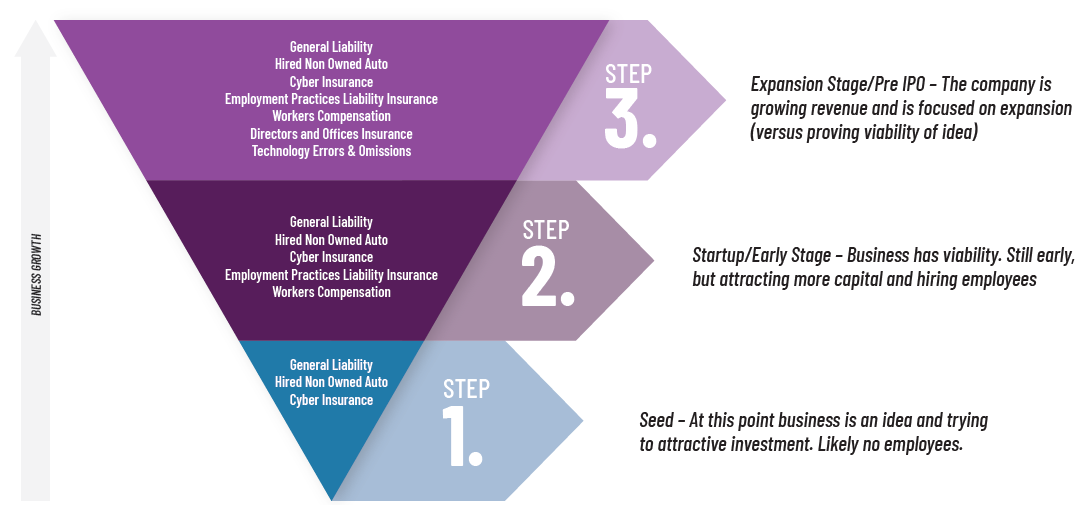

Underwriters at the best carriers rely on insurance agents to explain all aspects of the client’s business to offer the right policy. Every product produces different risks that should be acknowledged and accounted for. Before taking your scenario into consideration, the average tech startup Seed Round insurance package often includes coverage for the following:

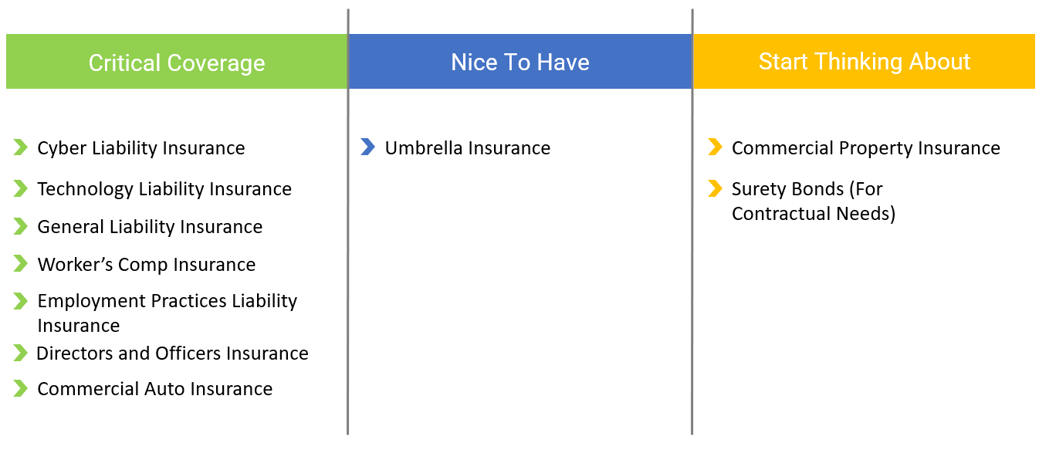

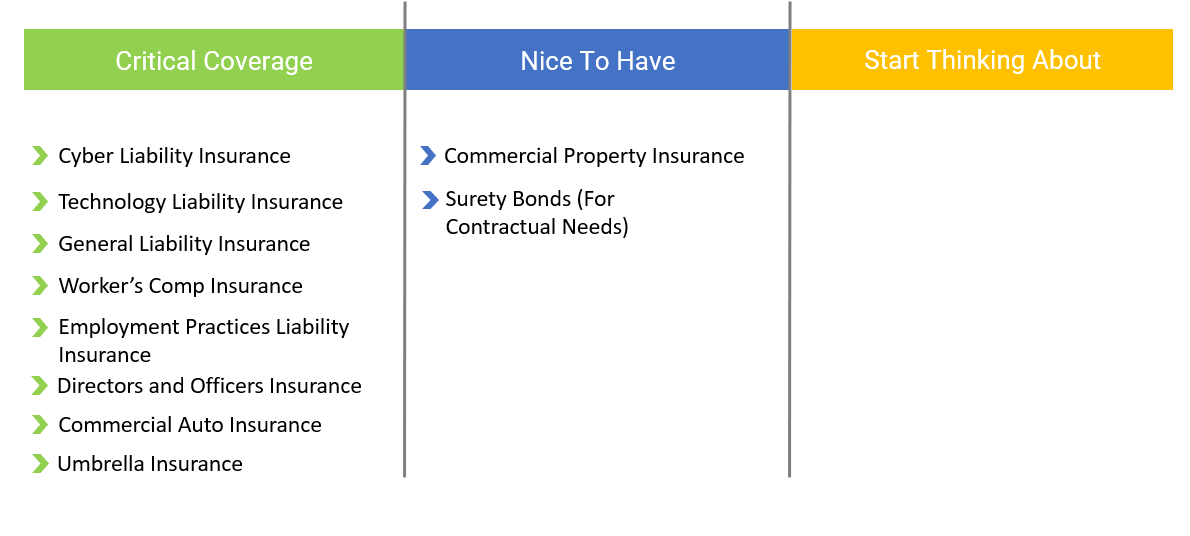

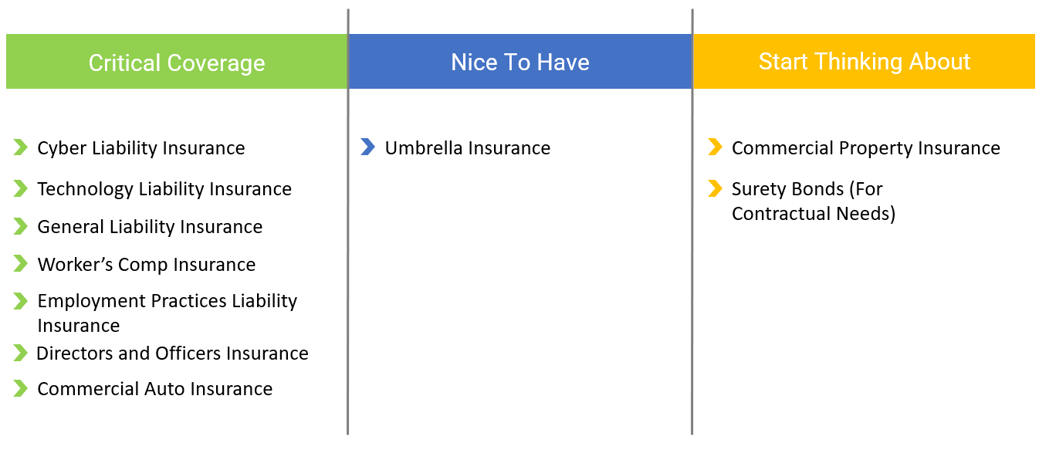

Critical Coverage

There are a few major differences in insurance between the idea phase and seed funding in a startup. Those are: directors and officers and employment practices liability insurance become musth haves. On top of that, policies like cyber liability, technology liability, general liability, and worker's compensation tend to require larger coverage limits.

Coverage limits vary depending on needs, but we often see a five times increase on essential policies during this period. For example, to protect technical assets and data, cyber liability and technology liability policies typically have coverage limits of $5,000,000 after a company reaches seed funding.

Nice To Have Coverage

An umbrella policy continues to be a nice to have as the chances of major exposure to damages increases while your startup scales. Most tech startups at this point should have an umbrella policy with at least a $1,000,000 coverage limit, but we see most with upwards of $5,000,000.

Start Thinking About Coverage

Now that money is beginning to come in, your business is probably considering either leasing or purchasing an office. This addition will require a commercial property insurance policy.

.png)